Prime Minister Employment Guarantee Programme [PMEGP]

The central government has established the PMEGP scheme to provide employment opportunities to the country’s unemployed youth. Loans ranging from ₹10 to ₹ 25 lakhs are made available to the country’s unemployed youth in order for them to start their own businesses. The primary goal of this scheme is to create job opportunities for the country’s youth through the establishment of micro-enterprises in the non-agriculture sector.

The Prime Minister’s Employment Generation Programe (PMEGP) merged two previous schemes, namely the Prime Minister Rojgar Yojana (PMRY) and the Rural Employment Generation Programe (REGP), both of which aimed to create employment opportunities for young people.

The Parameters used by the Central Government to frame the scheme are as follows

Backwardness of the state

State population

Availability of traditional skills and raw materials

Unemployment within the state

Features

The government will award 75 projects in each district under this scheme.

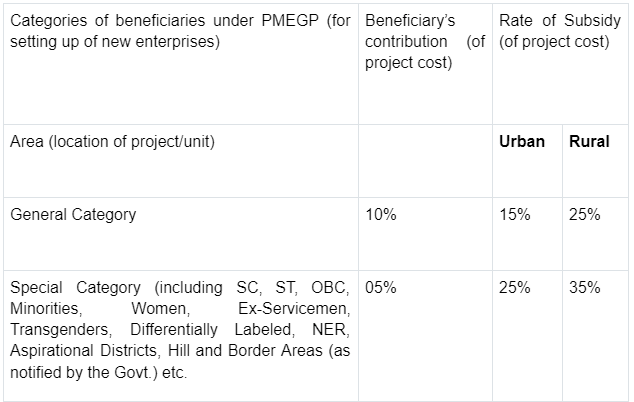

Women, SC, ST, OBC, physically disabled, and NER applicants will receive higher subsidies.

The government will administer the entire scheme process online. Everything will be done online, starting with the distribution of application forms and ending with the money being credited to the account.

Industries Which Can Be Set Up Using the PMEGP Scheme Benefits

Forest-based industries

Mineral based industries

Food & agriculture industry

Engineering & chemical based industry

Textiles (except khadi)

Service based industries

Non-conventional energy-based industries

Eligible Borrowers

Any individual, above 18 years of age.

No income ceiling for assistance for setting up of projects under PMEGP.

Should possess at least VIII standard pass educational qualification for setting up of project costing above Rs.10 lakh in Manufacturing sector and above Rs.5 lakh in Business / Service Sector.

Only new projects.

Existing units (PMRY, REGP or any other scheme of Govt. of India or State Govt.) and the units that have already availed Govt. Subsidy under any other scheme of Govt. of India or State Govt. are not eligible.

Projects without capital expenditure are not eligible.

Cost of land is not included in Project Cost.

Only one person from one family (self and spouse) is eligible under this scheme

Range: 3 to 7 years after an initial moratorium period.

For MSMEs: RLLR linked

For Non MSMEs: RLLR and MCLR Linked (based on activities)

Benefits of CGTMSE Scheme

The Ministry of Micro, Small and Medium Enterprises (MoMSME) has approved the continuation of the PMEGP Scheme for 5 years from FY 2021-22 to FY 2025-26. The scheme is implemented by KVIC which acts as Nodal agency at State level. The State director of the concerned state is authorized to monitor and implement the scheme and activities under BFL besides attending various meetings and workshops.

Note:

Maximum cost of Project/unit for Margin Money Subsidy

Manufacturing Sector: Rs.50 lakh.

Business / Service Sector: Rs.20 lakh

The Balance amount of total project cost is provided by Bank

If the total Project / Unit Cost exceeds Rs.50 lakh and Rs.20 lakh for manufacturing and Business / Service sector respectively, the balance amount may be provided by the Bank without any Government Subsidy.

Note:

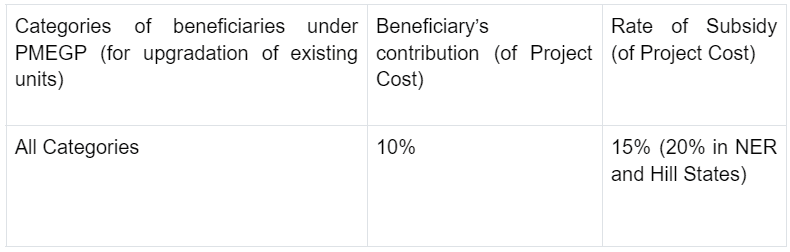

Maximum cost of Project/unit for Margin Money Subsidy for upgradation

Manufacturing Sector: Rs.1.00 crore. Maximum subsidy would be Rs.15 lakh (Rs.20 lakh for in NER and Hill States)

Business / Service Sector: Rs.25 lakh. Maximum subsidy would be Rs.3.75 lakh (Rs.5 lakh for in NER and Hill States)

The Balance amount of total project cost is provided by Bank.

If the total Project / Unit Cost exceeds Rs.1.00 crore and Rs.25 lakh for Manufacturing and Business / Service sector respectively, the balance amount may be provided by Bank without any Government Subsidy.

Process flow and steps

Step1

Know the eligibility criteria

Age above 18

No income ceiling

Proprietorship firms only

Education above 8th

Only for new project

Not for other scheme beneficiaries

Step2

Approach the bank & apply through PMEGP portal

Nodal agencies & implementing agencies– KVIC, KVIB & DIC

Application will be forwarded to nodal agencies

Nodal officer discussion with applicant

Correction ,scoring and negative list checking

Forward correct application to bank

Step3

Sanction of loan

Sanction letter copy will be forwarded to IA & applicant

Sanction letter forwarded to online EDP portal

Step4

EDP training

Step5

Loan disbursement

Step6

Subsidy release

KVIC transfers subsidy to your bank. It will have lock in period of 3 yrs and will be kept as FD without any interest. The subsidy amount will be deducted from total chargeable loan amount,i,e no interest will be charged for this subsidy[loan] amount.

Step7

Subsidy disbursed to applicant after 3 yrs

contact us

Contact us

Like what you’ve seen? Get in touch to learn more.